Bankers Association of Zambia (BAZ) Chief Executive Officer (CEO) David Chewe has called on members of the public and businesses to quickly acquaint themselves with the newly introduced Cheque Truncation System (CTS) for them to transacting efficiently.

Truncation is a mathematical way of restricting the precision of a decimal number by limiting the digits to the right of the decimal point without rounding.

Mr. Chewe said people should take interest in using the new system and collect new cheque books from their respective banks so as not to issue non cheque truncation system (CTS) cheques which will not be accepted for deposit now that the CTS is in place.

In an interview with ZANIS in Lusaka today, Mr. Chewe said the new CTS system was a good development for the country and a boost to financial activities as it had reduced the number of days it took to clear a cheque.

He said individuals and corporate entities that had issued cheques before the changeover date of 1st February, 2013 should not worry.

He explained that in essence, any cheque is valid for a period of six (6) months adding that cheques that were issued prior to the changeover date would still be valid and cleared for a period up to 31st July, 2013.

Mr. Chewe disclosed that banks would continue carrying out sensitisation activities to make the public aware of the benefits of the new system and also on some of the features on the new cheques.

The BAZ Chief Executive cited the use of black ink when writing on the cheques as among the key issues banks were placing their sensitisation on.

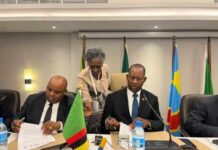

Early this month, the Bank of Zambia (BoZ) in partnership with the Bankers Association of Zambia (BAZ) and the Zambia Electronical Clearing House Limited (ZECHL) introduced the cheque truncation system (CTS) which is an efficient method of clearing cheques using images between banks instead of sending physical cheques presented for payment in a bank by individuals or corporate bodies.

The previous clearing method for cheques involved the capture and transportation of the physical cheques to the two central clearing centres in Lusaka and Kitwe. The clearing cycle took about three (3) to seven (7) days for a cheque to be given value, making the process inefficient and expensive as banks spent a lot of money to move cheques around the country.

JOIN DRIVERN TAXI AS PARTNER DRIVER TODAY!

JOIN DRIVERN TAXI AS PARTNER DRIVER TODAY!