UK and Zambia sign a Double Taxation Agreement

It replaces an agreement between the UK and Zambia of 1972.

Today 4 January 2014 the United Kingdom (UK) and Zambia signed a Double Taxation Agreement that will see businesses and individuals in both countries paying tax fairly and equitably

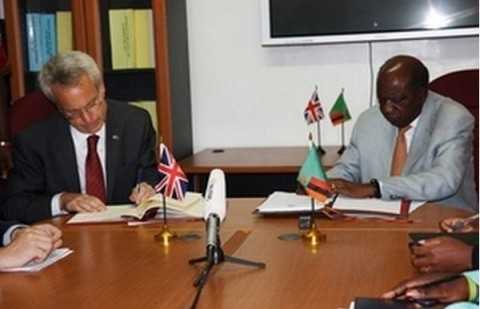

The Zambian Minister of Finance, Alexander Chikwanda, signed on half of the Zambian Government while James Thornton, British High Commissioner to Zambia, signed for the UK at a ceremony held at the Ministry of Finance in Lusaka.

The Agreement replaces the existing Double Taxation Agreement between the UK and Zambia. Double Taxation is the levying of tax by two or more jurisdictions on the same declared income, asset or financial transaction. This double liability is often mitigated by tax treaties between countries.

At the signing ceremony today James Thornton said;

“I am delighted to be signing this Double Taxation Agreement.

The UK and Zambia have a very strong partnership. In part it is based on a substantial development co-operation programme, which last year reached its biggest ever size. But, as Zambia grows more prosperous, it is important that it also has a strong commercial basis. I am pleased that trade between our two countries has been growing steadily recently.

This Agreement will help underpin that commercial relationship. It replaces an agreement between our two countries that dated from 1972, and which had become somewhat out of date.

The new Agreement takes account of changes in the taxation policies of both our countries, and of international developments in this field. A particularly important new provision is for the exchange of information between our financial authorities to help combat tax evasion.”

Further information

- It is common for a business or individual who is resident in one country to make a taxable gain (earnings, profits) in another. Without agreement such as avoidance of double taxation it may mean that a person or business may find that he is obliged by domestic laws to pay tax on that gain where he or she is resident and pay again in the country in which the gain was made.

- Since this is inequitable, and not good for business therefore many nations make bilateral double taxation agreements with each other.

More information on double taxation can be found on Her Majesty’s Revenue & Customs website

For further information, please contact the British High Commission on +260 211 423200 or follow us on Facebook and Twitter

JOIN DRIVERN TAXI AS PARTNER DRIVER TODAY!

JOIN DRIVERN TAXI AS PARTNER DRIVER TODAY!